Security Alert

I. The provisions

Pursuant to Article 2 of Legislative Act dated 20.03.2020 (adopting measures to halt the spread of Covid-19), businesses, whose operation has been suspended or temporarily prohibited (“Closed Businesses”) by virtue of special extraordinary measures taken for precautionary purposes related to Covid-19, benefit from a 40% reduction in the rent of March and April 2020 for the commercial lease of their premises. Applicable stamp duty or VAT -as the case may- will be calculated on the accordingly reduced rent. Payment of reduced rent does not trigger termination of the lease by the Lessor or any other civil claim. The above are also applicable to financial leasing agreements of movables or immovables concluded for professional purposes only, where the Lessee is a Closed Business. Last, the above are applicable to residential leases where the Lessee is an employee of a Closed Business by virtue of an employment contract in force upon enactment of above Covid-19 related special measures.

II. Application

The above provision covers commercial leases for all types of premises, i.e. offices, warehouses, stores, etc. and all such leases a business may have in place, as well as residential leases only of employees working in Closed Businesses.

The above provision applies only to businesses whose operation has been suspended or temporarily prohibited by virtue of a governmental decision, and not to business which have been affected, even to a great extent, by the Covid-19.

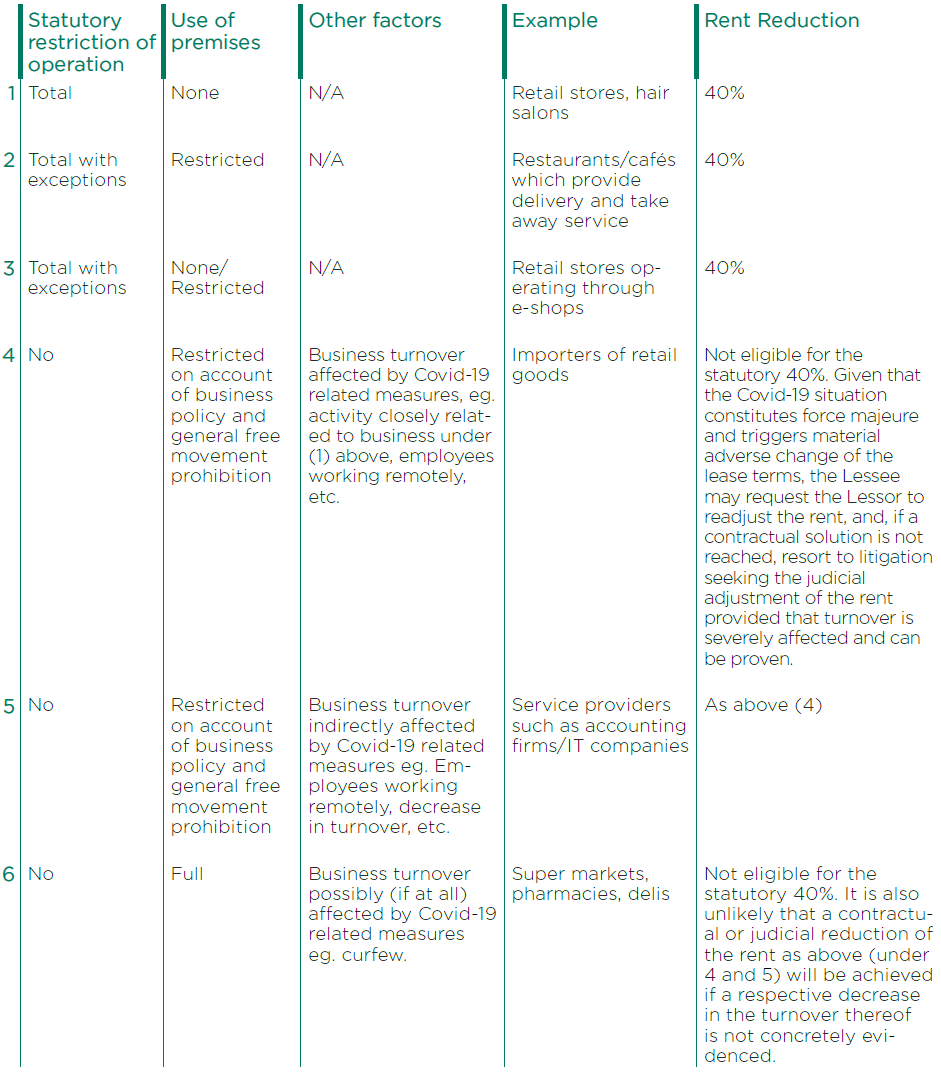

In the table below we categorize the types of businesses and their exposure to Covid-19 precautionary measures, which may benefit from the above provision

We note that in case the Lessee is already in default, (i.e. owes rents prior to the adoption of above measures) the Lessor is entitled to take legal action regardless of the measures to the extent such actions are not abusive. Moreover, if a relevant extrajudicial protest by the Lessor has already been served, the procedural deadlines for the eviction of the Lessee in default are suspended during 13.03.2020-27.03.2020 pursuant to the relevant special provisions adopted in view of Covid-19.

III. Procedure

In order to benefit from the reduction of the rent by 40%, Lessees shall need to fill the particulars of the Lessor and of the leased property in the declaration template form to be submitted to the ERGANI system by 31.03.2020, which should also include the particulars of their employees whose employment agreement has been suspended. Thereafter, the payment of the 60% of the rent may take place validly.

There are no official instructions (eg. in the form of a circular) on whether/how to accordingly notify the Lessors, but given that this issue is widely publicized, the vast majority of Lessors are aware that the lease they have in place falls under the rent reduction regime. Nevertheless, given that the above are unprecedented practices in trying times, in order to show goodwill, it is advisable to make contact with the Lessor (via email or the phone) and inform them of the submission of a declaration to the ERGANI system and the payment of reduced rent. It is highly likely that the Lessor requests a copy of the submitted declaration form or of the proof of submission thereof for their files, and for future use with the tax authorities/credit institutions (in case they have credit facility agreements in place). Ιn that case, prior to forwarding them such a copy, it is advisable to erase the names and particulars of the employees of the business that appear on the form for data protection purposes.

Important Note: The above are general guidelines. Under all circumstances, it is advisable, to review each lease separately and assess the facts of each case in order to confirm whether the Lessee may benefit from above 40% reduction scheme and whether a contractual/judicial rent reduction can be sought.