Security Alert

On 4 December, the Greek Parliament voted new law 5162/2024 adopting provisions aiming to strengthen income and economic resilience, to the expansion of existing and the introduction of new tax incentives for R&D, to the promotion of innovation and startup businesses, and to the reform of rules on business transformations and other provisions (“the Law”).

We have selected and summarised in this newsletter the most noteworthy topics from a corporate tax standpoint.

Consolidation & simplification: After many years of in parallel application of four different tax incentive laws to corporate transformations, namely law 1297/1972, law 2166/1993, law 2778/1998 and law 4172/2013 (“ITC”), the time has come for their abolishment and replacement by a uniform framework. Notwithstanding the aforesaid consolidation the Law brings, law 4935/2022 providing incentives to SMEs’ transformations and the special regime of law 2515/1997 for credit institutions, remain effective. On the other hand, transformations of REICs are covered by the Law.

Scope: In a nutshell, the Law provides for the tax neutrality on domestic and cross-border mergers, divisions, partial divisions, spin offs and legal form conversions (together referred to as “corporate transformations”) as well as share exchanges. As regards cross-border situations, the foreign EU entity involved must fall under the scope of the EU Tax Merger Directive, while specifically as regards spin-offs and share exchanges, the ambit is extended, and a foreign non-EU entity may be involved provided it is a tax resident in a country having in force a Double Tax Treaty or Mutual Administrative Assistance Convention with Greece.

The Law also provides the framework for the contribution of a sole proprietorship or a joint venture to another entity and sets the tax treatment for Greek shareholders in case of transformations or share exchanges of foreign tax-transparent companies.

Effective date & transition: The new regime applies if the relevant merger/division plan or corporate resolution for conversion/acquisition of shares under a share exchange is published or re-published after the effective date of the Law, i.e. 05.12.2024. Transformations /exchanges already performed under a repealed regime or for which the aforesaid plan or corporate resolution was published before 05.12.2024, shall be governed by the respective repealed regime opted for.

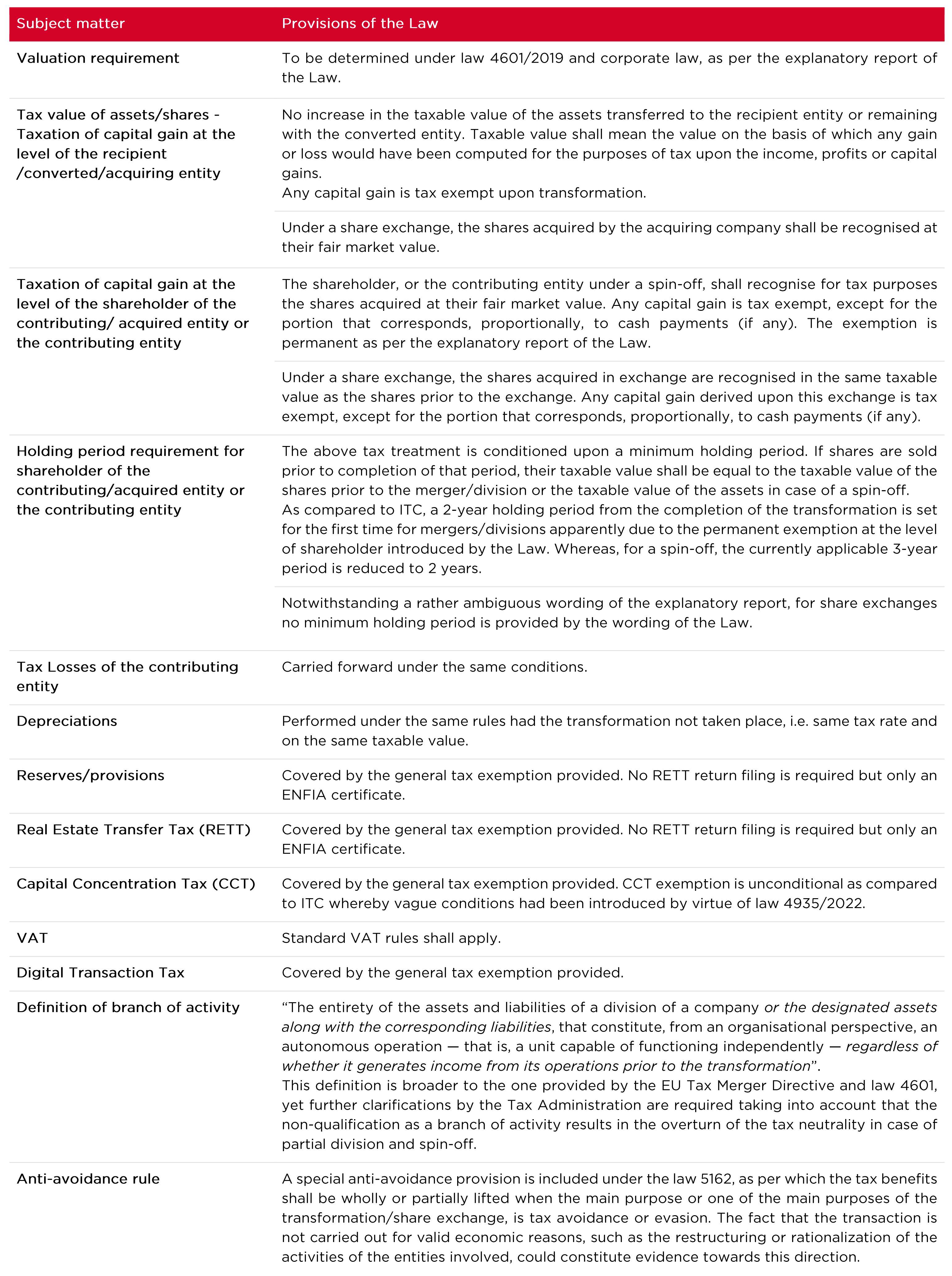

Main aspects: The Law, as compared to repealed regimes, does not set any strict restrictions in terms of the legal form, years of operation of the transformed entities or minimum capital. With respect to the main areas of interest and the main differences as compared to previous regimes, as regards transformations and share exchanges, the provisions of the new law could be summarised as follows:

Article 98 extends the scope of application of the intragroup dividend tax participation exemption (art. 48 ITC) and the capital gains participation exemption (art. 48A ITC) in order to include also the receipt of dividends and the capital gains from the transfer of shares/titles in non-EU tax resident legal person, under the fulfillment of certain conditions.

The conditions to be fulfilled at the level of the distributing person or the person the shares/titles of which are transferred are as follows.

The legal person shall have the form of a capital company under the legal framework of its country of establishment.

The legal person shall not be located in a non-cooperative jurisdiction, as this is defined in article 65 ITC.

The legal person shall be subject to corporate income tax or other similar tax, without the possibility of an option or exemption.

The recipient of the dividends/the transferor shall hold a minimum 10% of the capital or voting rights of the entity the shares/parts of which are being transferred.

The minimum holding shall be for at least 24 months.

Following the introduction of the above rules, the special anti-abuse rule capturing tax exemption of dividend income per article 48 is also extended to relevant income stemming from subsidiaries located in third countries.

Additionally, the transitional rule regarding the loss recognition under article 48A is extended to capture any loss arising also from the transfer of shares/titles of subsidiaries located in third countries. Specifically, losses from transfers of shares/titles in subsidiaries located in third countries falling within the new ex-tended scope of article 48A could be recognised for income tax purposes only if finalised until 31.12.2026 and provided that the relevant participations had been valuated until 31.12.2023 and that the losses had been recorded in books or audited financial statements.

The Law further re-introduces that the benefit arising at the level of a debtor from the debt forgiveness offered among others by credit or financial institutions as part of an out-of-court settlement or agreements in accordance with law 4469/2017, or within the context of the out-of-court mechanism of law 4738/2020 or following the issuance of a court decision, shall constitute tax exempt income. The new rules do not seem to set a time threshold as to when the debts should have become overdue or contested or when the mutual agreement or extrajudicial settlement etc. should have taken place, contrary to what was provided under article 62 of law 4389/2016. The provision introduced shall apply to taxes for which liability arises after 01.01.2024, therefore, it may be derived that the exemption shall be available for such debt write-offs realized as of 01.01.2024.

Article 22A ITC is amended with article 35 of the Law and provides that R&D expenses paid towards registered startups and certain research and innovation centers and universities specified in the Law (provided that they are unrelated parties with the recipient of the project or service), are tax deductible increased by 150%, subject to the governmental approval procedure already set in the ITC.

Furthermore, as regards SMEs an increased super-deduction of R&D expenses from their gross revenues is introduced. Specifically, insofar R&D expenses exceed 20% of the total annual expenses, a super-deduction at a 200% rate would apply in the year they are incurred. Should the annual R&D expenses exceed the average of the two previous years, the expenses should be deductible further increased by 15%.

If losses arise after the deduction of the above percentages, where applicable, they shall be carried forward on the basis of article 27 ITC.

Article 71A ITC provided that an income tax exemption for profits of an enterprise arising from the exploitation of internationally recognised patents on its name was available for three consecutive tax years. By virtue of article 37 of the Law, the patent incentives are extended and now additionally provide that the relevant enterprise may receive a 10% exemption of the payable tax amount corresponding to the aforementioned profits and for the subsequent seven consecutive years, insofar the development of the patent can be linked and further substantiated with respective R&D expenses.

For legal persons and entities with a tax year ending on 31 December, a specific period for filing their annual income is set in the law with effect as of the tax year 2024. The period starts on 15 March (or on the next working day if this falls on a Saturday or non-working day) and ends on 15 July, of the following year. Up to now, the law set only a deadline, which was expiring for such persons and entities on the last working day of June and which was every year extended on a case-by-case basis. No changes are introduced in respect of tax years ending on other dates.

Under this article, as regards legal persons and entities with a tax year ending on 31 December, the relevant legal provision is amended to provide, presumably on a permanent basis, that, with effect as of the tax year 2024 onwards, payment of tax is done in eight equal monthly instalments, with the first one paid until the last working day of the month of July of the following year and the following seven until the last working day of the following seven months respectively (rules that were up to now set through extraordinary legislative amendments).

In accordance with the explanatory report in the Law, these changes in relation to filing dates and payment instalments are now firmly set in the law, in order to enhance compliance.

In addition, as far as the calculation of corporate income tax is concerned, paragraph 3 of article 68 is now amended to provide that the possibility to obtain a foreign imputation tax credit in respect of the corporate income tax paid by the distributing entity corresponding to the dividends distributed as well as the tax withheld is extended to cover also third-country subsidiaries.

The above shall apply from tax year 2024 onwards.

New provisions delineating the tax treatment of Greek-based close-ended mutual funds of article 7 of law 2992/2002 (hereinafter referred to as “AKES”) and their unitholders have been introduced by virtue of article 38 of the Law, in an attempt to address the need for more clarity on the Greek tax treatment of the AKES and their unitholders, rendering the AKES an attractive investment vehicle on the Greek securities market.

Taxation at the level of the AKES incorporated until 31.12.2024: as in force

With reference to the AKES that will have been incorporated until 31.12.2024, the existing tax regime, according to which the AKES are not subject to Greek taxation, shall remain applicable.

Taxation at the level of the AKES incorporated as from 1.1.2025: election of the preferred tax regime

Pursuant to the new provisions, AKES that will be incorporated as from 1.1.2025, may elect their preferred tax regime between the existing tax regime of paragraph 21 of article 7 of law 2992/2002, and a new tax regime introduced by virtue of the Law, by way of a return to be submitted on the day of commencement of their operations.

New AKES opting for the new tax regime shall be subject to Greek taxation at a rate of 5% on the applicable – as at the time of tax return filing – main refinancing operations interest rate of the Eurosystem of the European Central Bank (hereinafter the “reference rate”). Such tax shall be calculated annually on the basis of the difference between the value of the AKES participations as reflected on 31 December of each tax year and the acquisition cost of such participations increased by the cumulative operational costs of the AKES. According to the former rules, the AKES had not been liable to Greek taxation, as it should be treated as a tax transparent entity.

The management company of the AKES is obliged to file an annual tax return and pay the tax so assessed in the name and on behalf of the AKES. A credit of the tax effectively paid abroad against Greek tax shall be applied and in the event that such foreign tax exceeds the Greek tax assessed, the difference shall be carried forward and shall be credited against Greek tax to be assessed in the following tax years.

Payment of the assessed tax by the management company shall exhaust the income tax liability of the AKES unitholders for any income arising in the period during which they maintain their units in the AKES.

Profits in the form of dividends or other benefits arising from AKES units at the level of the unitholders shall not be subject to withholding tax in Greece.

Application of the new rules to Greek AIFs

Pursuant to article 56 of law 4706/2020 regulating the incorporation and operations of Greek AIFs (Alternative Investment Funds of law 4706/2020), the provisions stipulating the Greek tax treatment of the AKES apply uniformly to the Greek-based AIFs. Therefore, the new enacted provisions delineating the two alternative Greek tax regimes optionally applying to the AKES and their unitholders, shall equally apply to the Greek AIFs and their unitholders. It is noted that as far as EU-based AIFs managed by Greek-based management companies are concerned, it is still unclear whether the new provisions shall apply equally to them.

Child related incentives

Article 4 introduces two more cases of benefits granted by employers to their employees which shall be exempt from employment income tax, as a form of childbirth incentives. Specifically:

In order for the above exemptions to apply, the employer should i) extend the relevant benefit in cash (if paid to the employee’s bank account) or kind (if for instance paid directly to the kindergarten or in the form of vouchers to the service provided) to all its employees mandatorily and notify them accordingly using one of the methods provided under labour legislation, ii) notify the competent labour authority of relevant benefits, iii) grant it on top of agreed remuneration, iv) be able to demonstrate the use of the relevant amounts for the above purposes.

Tips to employees – penalty for the employer

Articles 5 and 11 provide for the employment income tax exemption and social security exemption of tips received by employees by their employer’s customers (either directly from the customer or through the employer company), up to the amount of EUR 300 per month, subject to the fulfillment of certain conditions.

In the context of such introduction, article 5 further provides for the imposition of penalties to the employing company, in case the latter proceeds with a reduction of the employee's remuneration and at the same time the employee receives aforementioned tips.

Namely, it is provided that in the event of a reduction in the employee's monthly regular remuneration with a simultaneous increase in the amount of tips, which occurs from 1.11.2024 and onwards, a penalty of 22% of the amount of the reduction is imposed on the employer, calculated for a period of 12 months from the reduction and not beyond the month in which the regular remuneration is restored to the original pre-reduction amount.

Reduction of health insurance contributions rate for employees

Article 12 provides for the reduction as from 1.1.2025 of health care insurance contributions for employees subject to the National Organisation for Health Care Services (EOPYY) from the current rate of 7.10% to 6.10% for all their earnings. This shall be divided into 5.45% for benefits in kind, of which 1.65% shall be borne by the insured person and 3.80% by the employer, and 0.65% for cash benefits, of which 0.40% shall be borne by the insured person and 0.25% by the employer.