Following Press Release of 28 June 2021, the Ministry of Finance and the Independent Authority for Public Revenue issued Ministerial Decision A. 1156/2021 providing additional guidelines on the implementation of e-books and new deadlines for data transmission.

Revised timeline for data transmission

By virtue of Ministerial Decision A. 1156/2021, the revised timeline for the data transmission to myDATA platform for FYs 2020 – 2022 has been released. In summary:

FY2020

- Data transmission is optional for FY2020 except for enterprises implementing e-invoicing through certified E-Invoicing Service Providers; in such case, the obligation applies as of 20 July 2020 and concerns the summary data of revenue and self-billing expenses while transmission of classifications of such data is also possible as of that date.

- In case of optional implementation (via other transmission methods), the summary data and classifications of revenue and self-billing expenses pertaining to the period from 1 October 2020 until 31 December 2020 can be uploaded to the platform by 28 February 2021. In case of non-transmission of the above data by the invoice issuer, these may be uploaded by the recipient from 1 March to 31 March 2021 while the issuer may accept and classify such transactions by 30 April 2021.

- Summary data and classifications of expenses and self-billing revenue pertaining to the period from 1 October 2020 until 31 December 2020 can be uploaded to the platform by 31 March 2021.

- For payroll entries, the October - December 2020 data can be uploaded by 31 March 2021.

FY2021

_Obligation for transmission regards mainly the revenue data and in particular the following items (mandatory transmission):

- Summary data and classifications of revenue invoices;

- Summary data and classifications of self-billing expenses;

- Data of the proofs of expenditure issued by the taxpayer.

_Commencement date of transmission as per the above depends on the FY2019 turnover and the type of accounting books maintained by the taxpayer, namely:

- For taxpayers keeping single-entry accounting books with a FY2019 turnover exceeding EUR 100,000 as well as for taxpayers keeping double-entry accounting books with a FY2019 turnover exceeding EUR 50,000, the transmission obligation commences as of 1 October 2021.

- For all other taxpayers, the transmission obligation commences as of 1 November 2021.

_Data pertaining to the period from 1 January 2021 until 30 September 2021 or 31 October 2021, respectively, must be uploaded to the platform by 31 March 2022 unless already transmitted previously. In case of non-transmission of the above data by the invoice issuer, these may be uploaded by the recipient from 1 April to 30 April 2022 while the issuer may accept and classify such transactions by 31 May 2022.

- Summary data and classifications of expenses as well as summary data and classifications of self-billing revenue can be uploaded to the system by 31 May 2022 (optional transmission).

- Accounting regularisation entries of revenue must be uploaded to the platform by the deadline of filing of the CIT return of FY2021. The same deadline applies also for the accounting regularisation entries of expenses, however on an optional basis.

FY2022

_As of 1 January 2022, the obligation to transmit all data of both revenue and expenses (including summary data, classification of transactions and accounting regularisation entries) applies on a mandatory basis.

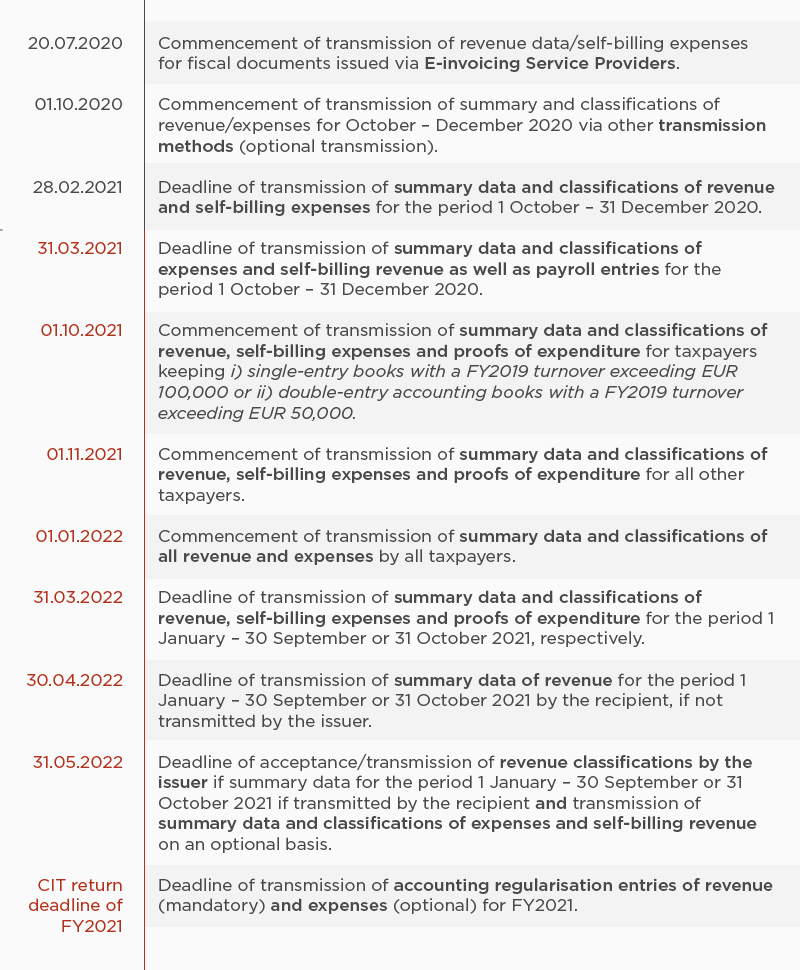

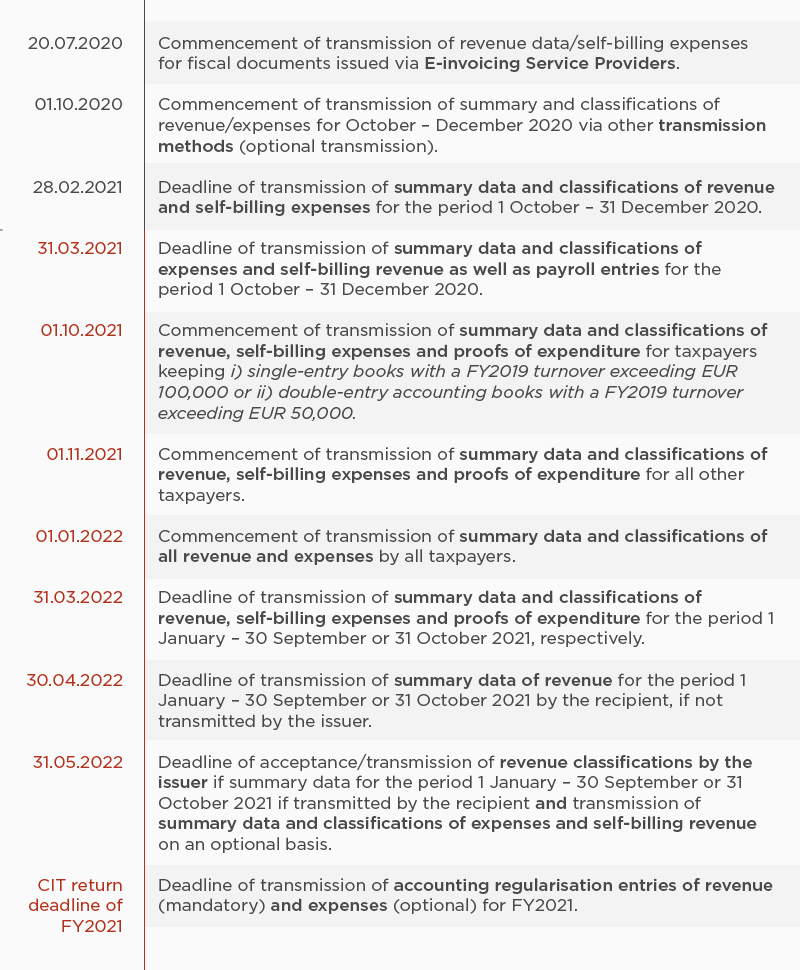

Table of key dates for myDATA implementation

Main critical dates for myDATA implementation based on the recent Ministerial Decision are summarised in the following chart:

Other significant changes and clarifications

_In addition to the revised deadlines of transmission, further changes have been introduced in the initial Ministerial Decision A. 1138/2020, aiming at clarifying certain aspects of myDATA obligations. Said changes indicatively involve:

- The data transmission obligation on an aggregate basis for businesses in specific sectors, such as utilities providers, telecommunication providers, tolls operators, credit institutions and the Bank of Greece is also extended to year 2022;

- The transmission of accounting regularisation entries of revenue and expenses at year-end closing can be made either on aggregate or analytical basis except for payroll and depreciation entries which should be distinctively uploaded to the platform;

- The transactions data may be uploaded in summary format without analysis of items and lines/entries unless the analytical reporting is required by the applicable legislation;

- In case the special myDATA application is used for data uploading (manual reporting), the transmission of data is made until the 20th day of the month following the issuance of the fiscal document or the accounting entry, if the revenue arises from an accounting entry;

- For the non-mirrored expenses fiscal documents (retail transactions, bank charges, utilities etc.), the recipient must transmit relevant data by the VAT return submission deadline (on a monthly or quarterly basis) depending on the type of accounting books maintained.

- In case of non-transmission of data by the invoice issuer, the recipient may transmit the relevant data within 2 months as of the deadline of submission of the VAT return applicable for single-entry accounting books (quarterly basis). The same deadline also applies for the transmission of a discrepancy notice by the recipient in case the issuer reports data with discrepancies.

- In the event of transmission of data by the invoice recipient, the issuer may transmit the classification of revenue within one month as of the above 2-month deadline. The same deadline also applies for the transmission of summary and classification of the revenue by the issuer in case of submission of discrepancy notice by the recipient as per the above.

_Additional clarifications are also expected in relation to the upgrade and interconnection process of Electronic Tax Register Machines (FIM) with myDATA platform to be gradually implemented within September – November 2021 as per the Press Release published on 28 June 2021.

Our firm is closely monitoring developments and is actively involved in supporting the set-up and implementation of e-books projects covering all tax and accounting aspects of myDATA framework.