Security Alert

The Greek Ministry of Finance and the Independent Authority for Public Revenue (“IAPR”) have released implementation guidelines of the e-books system on 22 June 2020 (Ministerial Decision A. 1138/2020). Greek businesses are now faced with the digital challenge of implementing the e-books and e-invoicing processes under tight deadlines.

Whom does it concern?

What type of data must be transmitted to myDATA platform?

Classification of transactions (revenue – expenses) must also be uploaded to the platform; uploading of classification of part of the data must be performed by Greek licenced accountants.

For the data subject to transmission, standardisation of format and level of information required per type of document is included in annexes of the Decision, aiming at a uniform uploading by all businesses.

How can data be transmitted to the platform?

Depending on the type of transactions performed, accounting books maintained and invoicing method, the following transmission methods apply:

What is the deadline for uploading the data?

Uploading of revenue data will take place in real-time in case of issuance through E-invoicing Providers or transmission through accounting/commercial ERP. In case of manual recording and self-billing or assignment of invoicing, the transmission will be possible until the 20th day following month of issuance.

For data transmitted by the recipients in certain cases, the VAT return filing deadline shall apply (depending on the type of accounting books maintained).

In case of retail transactions, for which ETRMs are directly linked with IAPR, relevant deadlines are specified in applicable provisions.

As regards accounting regularization entries data for the determination of accounting and tax result of each year, along with their classification, these must be transmitted until the corporate income tax return filing deadline except for payroll entries which must be transmitted until the payroll withholding tax return filing deadline.

Uploading of the classification of transactions depends on the method of transmission used as regards revenue data while, for expenses, the VAT return filing deadline will apply.

When does the obligation become effective?

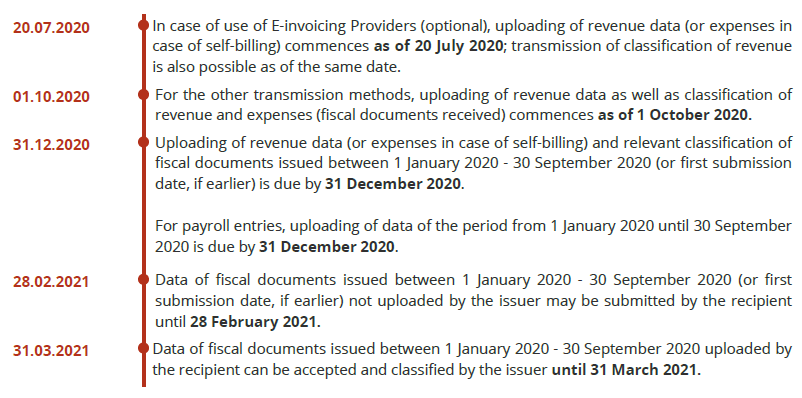

Initial implementation of the e-books system will be materialized in stages, namely:

Incentives for implementation of e-invoicing

A set of incentives has been introduced by virtue of L. 4701/2020 recently voted for the implementation of e-invoicing through E-invoicing Providers as an exclusive method of fiscal documents issuance. Such option must be declared with the Tax Administration and excludes the hard copy issuance of fiscal documents for as long as it applies.

Incentives introduced for businesses implementing e-invoicing through Provider consist in:

For businesses that will select and declare the acceptance of fiscal documents through E-invoicing Provider (recipients), the SoL period will be reduced from 5 to 4 years.

Above incentives will be effective for fiscal years starting from 1 January 2020 onwards and granted from the first year of e-invoicing implementation until fiscal year 2022. Exceptionally, for fiscal year 2020 the incentives will apply under conditions in conjunction with the e-books system implementation.

How we may help you with the challenges of implementing myDATA?

With a long tradition in accounting and tax advisory services and one of the most prominent and specialised tax teams in Greece, Zepos & Yannopoulos stands next to its clients, assisting them to capture the intricacies of the Greek tax and accounting system and successfully respond to the challenges of an increased compliance environment. Our economists and tax advisors have already established a plan for assisting your business with the adaptation to the newly introduced e-books system requirements, by virtue of: