Earlier today, the Greek Parliament ratified the third bailout program for Greece. A number of tax reforms are introduced as part of the new program agreed between Greece and its creditors. The present newsletter focuses only on changes in shipping taxation. A more detailed newsletter presenting all changes in Greek tax legislation will follow shortly.

Extension of scope of tonnage tax

Currently, tonnage tax applies to (i) vessels flying the Greek flag and (ii) vessels flying foreign flags, but for the latter only under the condition that their management is performed in Greece by companies that establish a Greek branch or office under a special license on the basis of article 25 of law 27/1975. Given that the application of tonnage tax attracts certain tax exemptions for ship owners and their shareholders, the European Commission considered that it is discriminatory and in infringement of European Union law to apply these tax exemptions only for vessels flying the Greek flag and not for vessels flying flags of member-states of the European Union or the European Economic Area (to which Greek tonnage tax does not apply in principle). In the light of the position of the European Commission, the scope of tonnage tax has been extended to cover certain categories of vessels flying flags of member-states of the European Union and the European Economic Area, so that they can enjoy equal tax treatment with vessels under Greek flag.

Increase of tonnage tax

According to law 27/1975, which first introduced tonnage tax, the Greek State has the right to increase annually the tonnage tax at an increase rate to be decided every five years. In 2011, it was decided that the nominal tonnage tax would be increased annually by 4% for years 2011-2015.

The Greek State has now decided to further increase the nominal tonnage tax for years 2016-2020 by 4% annually.

It is anticipated that the Ministry of Finance (MoF) will provide further guidelines on the applicable amounts of tonnage tax following the above increase.

Extension of annual contribution applicable to foreign companies operating in Greece under article 25 of law 27/1975

In 2013 an annual contribution was imposed for four years (2012-2015) on the offices or branches of foreign companies that have been established in Greece under article 25 of law 27/1975 and engage in the following activities:

- chartering, damage settlement, purchase, shipbuilding, chartering or insurance brokerage of vessels flying the Greek or a foreign flag whose capacity exceeds 500 gross registered tons;

- representation of ship-owning companies and other undertakings whose object is the same with the aforementioned activities.

Entities in question operate in principle under a regulated tax exempt regime and as part of the conditions for qualifying for this regime, they are required by law to import annually into Greece a minimum amount of foreign exchange or euros equivalent to USD 50,000.

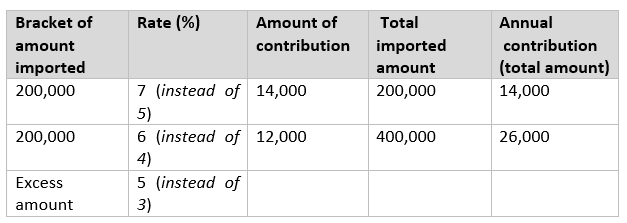

The applicable contribution is calculated in USD (although paid in Euro) on the amounts annually imported into Greece. The new law has extended the obligation to pay the annual contribution for four more years (2016-2019) and has increased the applicable rates, as follows (all amounts in USD):