Following years of postponements necessary for technical set-up and fine-tuning, myDATA reporting and e-invoicing implementation is fully deployed as of 1 January 2024 onwards, while penalties are due in case of non-compliance. Additional reporting formalities including data of digital transportation documents as well as extension of mandatory use of POS devices are shaping the digital tax compliance framework for Greek businesses.

Key recent developments on myDATA reporting, e-invoicing and use of POS devices by virtue of the recently published Decision A. 1170/2023, Law 5073/2023 and Decision 119899/2023 are outlined in this issue.

A. Regulations of decision A. 1170/2023

myDATA reporting changes

- Reporting of revenue data to myDATA platform through ERP systems is real-time effective as of 1 January 2024; exceptions apply for specific business sectors such as utility and tolls operating companies, credit institutions, telecom providers etc.

- For the reporting of expenses summary and classifications, the monthly or quarterly VAT submission deadline applies as of 1 January 2024 depending on the type of accounting books maintained by the taxpayer.

- The recipient of fiscal documents must report to myDATA platform any discrepancies or omissions of data transmission by the issuer before the relevant monthly or quarterly VAT return submission deadline.

- Taxpayers issuing retail fiscal documents via ECRs will transmit the relevant sales data either through their ERP systems or the special manual entry form up to 31 March 2024. As of 1 April 2024, the data of retail fiscal documents issued via ECRs will be transmitted to myDATA platform via the informational ECRs “e-send” system.

- In case of loss of connection with myDATA platform, the relevant data must be transmitted to the system within one day from the transmission deadline.

- For year 2024, the net value of fiscal documents must be accurately transmitted to the system while transmission of fiscal documents with nil value is not mandatory; transmission of data related to other taxes and duties (withholding taxes, other taxes, stamp duty, duties and deductions etc.) is also not mandatory.

New formalities

- Additional reporting formalities and the minimum content are introduced in relation to the transmission of data related to digital transportation documents as well as other documents such as restaurant orders, e-shops and payment-collection receipts via POS. Ministerial decisions are expected in order to provide all necessary implementation details.

- As of 1 January 2024, invoices issued through commercial ERP systems or the special IAPR application “timologio” should be marked with a two-dimensional barcode (QR code); such QR code contains a link for access to a digital service of myDATA platform providing direct preview in a web browser of either the summary or the entire document, or both, as transmitted to myDATA platform.

- A threshold will apply as of 1 January 2024 for the revenue and expenses declared in the VAT returns compared to data transmitted to myDATA platform, i.e. the revenues declared in the VAT return cannot be less than the revenue data transmitted to myDATA and the expenses declared in the VAT return cannot exceed the expenses data transmitted to myDATA, respectively – this new requirement regards transactions subject to VAT.

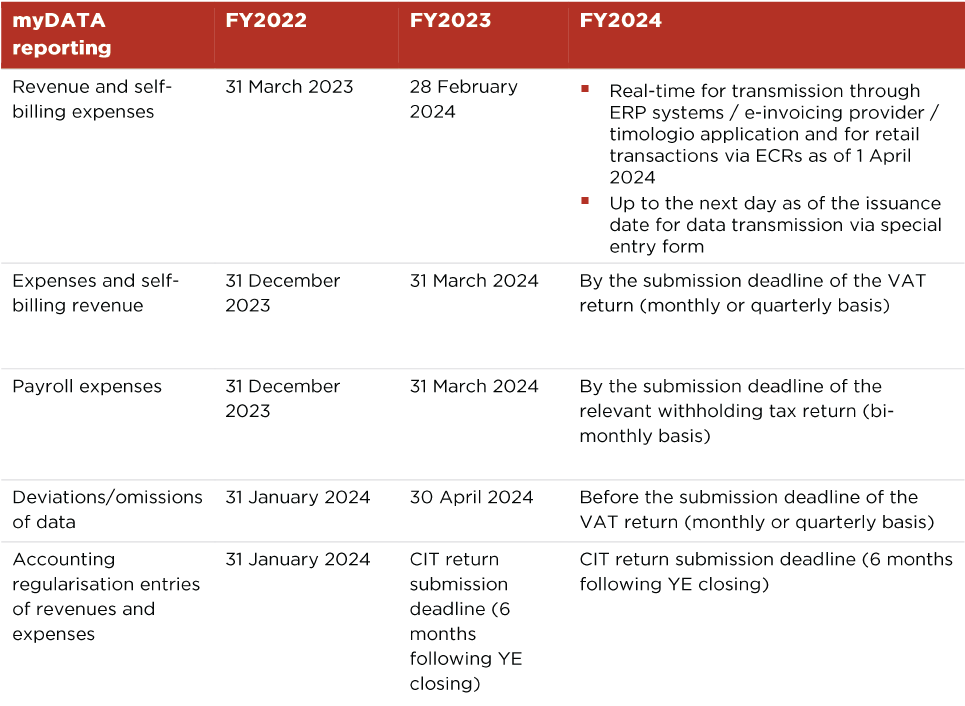

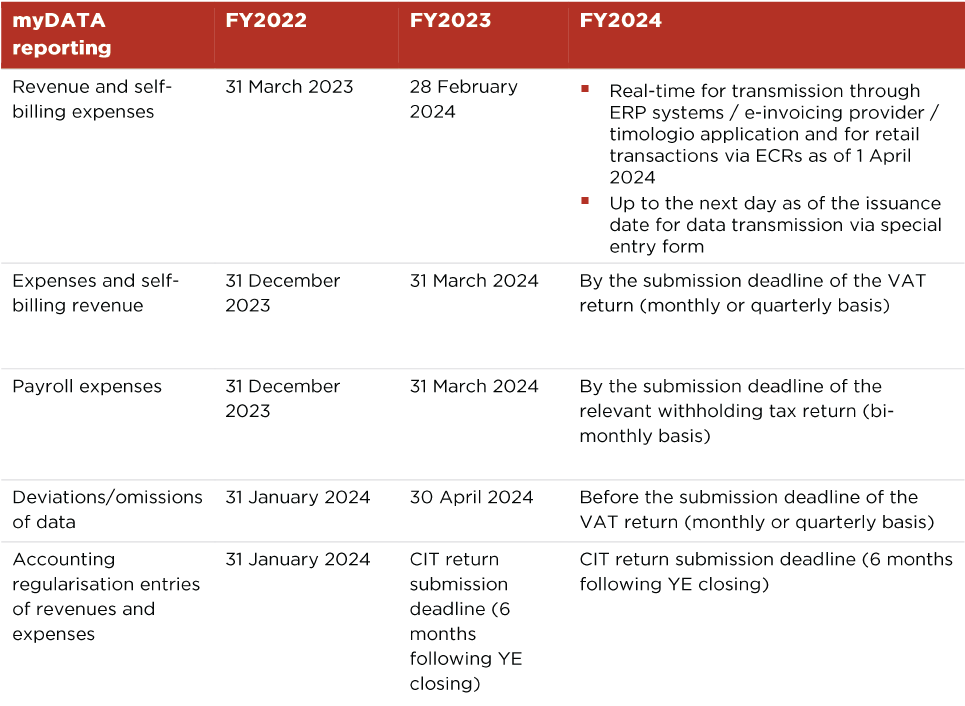

Summary of critical dates for the main types of data transmission

*Special deadlines apply for certain occasions as well as revenue reporting depending on the transmission method used and type of transactions (e.g. B2B, B2C or B2G sales).

myDATA revised technical specifications

B. Provisions of Law 5073/2023

Reporting of transactions: tax implications

- The value of taxable transactions and revenues to be taken into account by the Tax Administration for the determination of VAT and CIT position of a taxpayer cannot be lower than the value arising from the fiscal documents transmitted electronically to the IAPR (myDATA platform).

- Deduction of taxes and expenses will not be taken into account in case the relevant fiscal documents have not been transmitted electronically to the IAPR.

- The deadlines, specific transactions reporting, technical specifications, exemptions and details regarding the acceptable threshold of any discrepancies, which cannot exceed 30%, as per the above rules will be determined by virtue of Ministerial Decisions to be issued for such purposes.

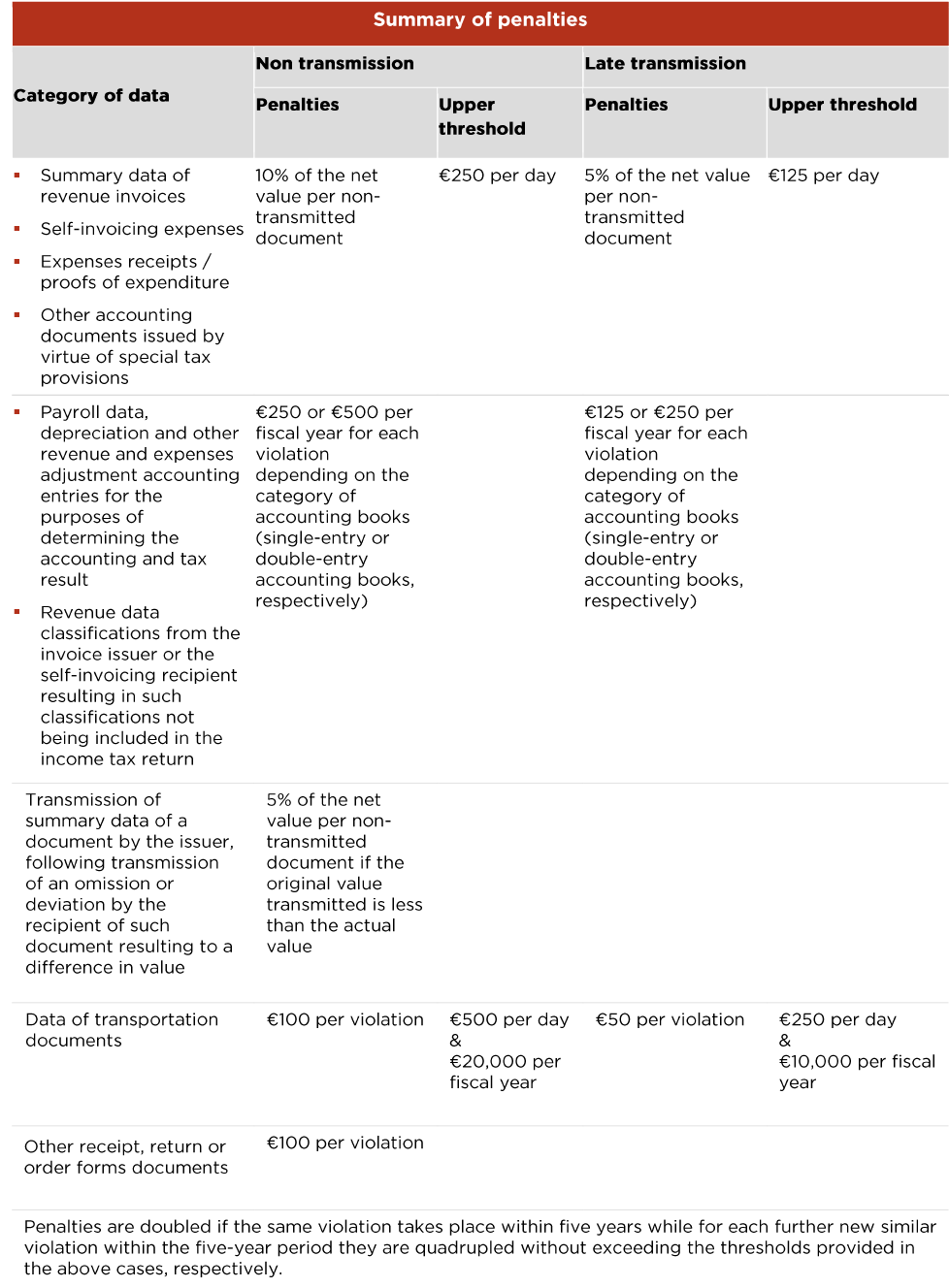

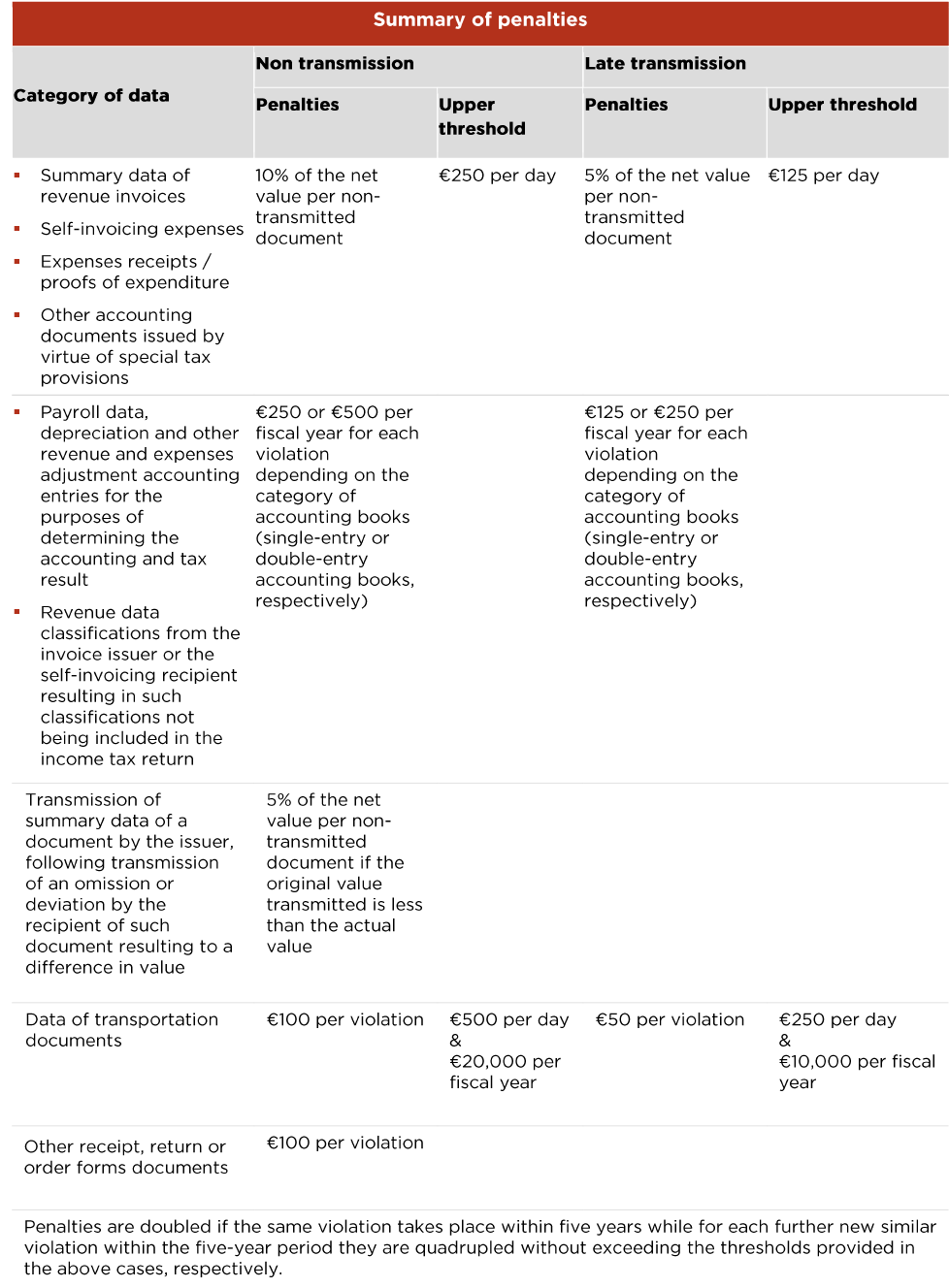

Penalties for data transmission infringements

- Penalties in case of non-compliance with the electronic data transmission obligations to the IAPR (myDATA platform) will be imposed depending on the type of violation.

- The applicable penalties framework is summarised in the below indicative table:

- Further implementation details and timeline will be determined by virtue of Ministerial Decisions to be issued for such purposes.

Tax incentives for e-invoicing

- Tax incentives for the implementation of e-invoicing granted to entities that opt for e-invoicing through certified e-invoicing service providers are extended to fiscal years 2023 and 2024 provided that the implementation process will be completed by 31 December 2023 and 31 December 2024, respectively.

C. Other recent developments

Gradual implementation of e-invoicing to B2G transactions

- By virtue of Ministerial Decisions 52445/2023 & 78366/2023, guidelines were provided for the issuance of e-invoices for public procurement (B2G) setting the implementation timeline gradually from 12 September 2023 to 1 January 2025 (general application for all B2G transactions) depending on the public authority and the type of contract; exemptions are in place for special cases (e.g. contracts of low value or specific confidential projects etc.).

- E-invoices for B2G transactions should have a standardised format as per the European Standard for electronic invoicing and should be issued by certified e-Invoicing Service Providers.

- No penalties framework has been introduced for non-compliance with B2G e-invoicing requirements; failure to comply with such regulations may result to the non-proper receipt and payment of such invoices by the contracting public authority.

Extension of mandatory use of POS to additional business activities

- By virtue of recent Decision 119899/2023, from January 2024 onwards businesses providing services to consumers or having declared Business Activity Codes included in the list stipulated per the above decision are under the obligation to declare in the IAPR platform the data of their professional bank accounts as well as accept payment means via cards (including POS) or via direct payment services from bank account to bank account (e.g. IRIS online payments).

- The obligation of accepting the above payment means is extended, among others, to activities such as retail sales via stalls and markets, life insurance, transportation services through taxi, leasing, real estate property sale, advertisement and marketing, call center services, conferences and training services, arts and operation of art facilities etc.

- Failure to meet the applicable POS formalities and obligations to declare professional bank accounts raises administrative penalties at the level of EUR 1,500 and EUR 1,000, respectively.