The new beneficial income tax treatment of stock options and share award plans has been one of last year’s pleasant surprises for Greek employers & employees. On 24 December 2020, the Independent Authority for Public Revenue issued the long anticipated guidance for the interpretation and application of the new rules.

Click here for the GR version – Πατήστε εδώ για το ελληνικό κείμενο

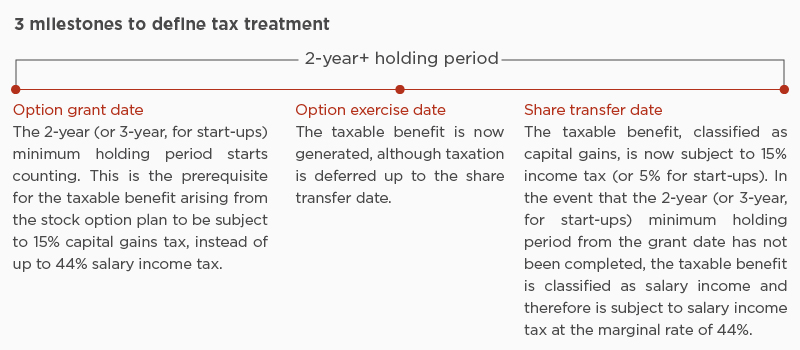

By way of reminder, according to the new rules, employee benefits from stock options and share award plans are treated as capital gains for income tax purposes, thus being taxed at a 15% rate (or 5% for start- ups), instead of the marginal 44% rate applicable on salary income.

Guidance on stock options plans

Taxable benefit on option exercise date

As regards listed shares, the taxable benefit is equal to the share market price on the exercise date, reduced by the option exercise price.

As regards non-listed shares, the taxable benefit is equal to the share value, defined on the basis of the company’s net asset value (as reflected in its accounting books) on the exercise date, reduced by the option exercise price.

Capital gain on share transfer date

Any capital gain to arise following the option exercise date and up to the share transfer date is taxable on the basis of the generally applicable capital gains tax provisions. Therefore, a 15% income tax will apply on capital gains from the disposal of non-listed shares. As regards listed shares, the capital gain in question will be tax exempt, provided that the seller holds less than 0.5% of the company’s share capital. Otherwise, the 15% income tax rate will apply. Any loss generated following the option exercise date and up to the share transfer date may be tax deductible, in line with generally applicable rules on carry forwards of losses from the disposal of securities.

Employer & employee tax compliance obligations

The employer should provide a certificate to qualifying employees at the end of the year within which the option has been exercised. The certificate should reflect the taxable benefit generated during the year. In addition, the employer should include the taxable benefit in the relevant withholding tax declaration filed on a monthly basis solely for reporting purposes since no withholding tax applies.

Accordingly, the employee should report the taxable benefit in the context of his/her annual income tax return of the fiscal year within which the option has been exercised. Reporting at that point is only for information purposes.

Scope of application of new tax treatment

The new rules apply on benefits arising from stock options exercised after 1.1.2020. According to the Ministerial Decision, the tax treatment in question applies only with respect to stock option programs issued by companies taking the legal form of a Societe Anonyme (“Anonymi Etairia”). Programs issued by other group companies also qualify under the same beneficial tax provisions.

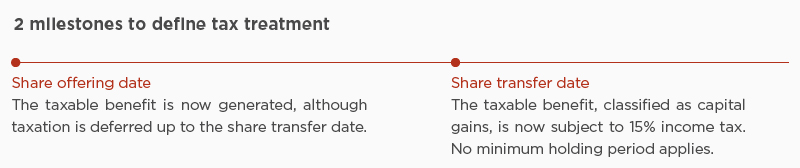

Guidance on share award plans

Taxable benefit on share offering date

As regards listed shares, the taxable benefit is equal to the share market price on the share offering date.

As regards non-listed shares, the taxable benefit is equal to the share value, defined on the basis of the company’s net asset value (as reflected in its accounting books) on the share offering date.

Capital gain on share transfer date

Any capital gain to arise following the share offering date and up to the share transfer date is taxable on the basis of the generally applicable capital gains tax provisions. Therefore, a 15% income tax will apply on capital gains from the disposal of non-listed shares. As regards listed shares, the capital gain in question will be tax exempt, provided that the seller holds less than 0.5% of the company’s share capital. Otherwise, the 15% income tax rate will apply. Any loss generated following the share offering date and up to the share transfer date may be tax deductible, in line with generally applicable rules on carry forwards of losses from the disposal of securities.

Employer & employee tax compliance obligations

The employer should provide a certificate to qualifying employees at the end of the year within which the option has been exercised. The certificate should reflect the taxable benefit generated during the year. In addition, the employer should include the taxable benefit in the relevant withholding tax declaration filed on a monthly basis solely for reporting purposes since no withholding tax applies.

Accordingly, the employee should report the taxable benefit in the context of his/her annual income tax return of the fiscal year within which the option has been exercised. Reporting at that point is only for information purposes.

Scope of application of new tax treatment

The new rules apply on benefits arising from shares offered after 1.1.2020. The same beneficial tax provisions apply irrespective of whether the shares are offered by the Greek employer company or any other Greek or foreign group company.

How we can help you

Our team at Zepos & Yannopoulos may assist you in evaluating current stock option and share award plans and designing new ones, taking into consideration, apart from the tax treatment of the executive employees:

- The tax and accounting treatment of the plan for the offering company

- The tax treatment of the associated expenses, specifically in case of plans granted by the parent company of the group to the employees of Greek subsidiaries

- The possibilities and limitations provided under corporate law, corporate governance and capital markets regulations, with respect to the design and implementation stock options and share award plans

- Employment law aspects of stock options and share award plans, as an alternative form of compensation of employees.