Security Alert

After months of anticipation, the Greek energy sector has reached a pivotal moment with the issuance of Ministerial Decision ΥΠΕΝ/ΓΔΕ/28255/1143 on 14.03.2025 (the “Decision”). This long-awaited Decision establishes the Merchant Battery Energy Storage Systems (BESS) Priority Regime under Article 11D of Law 4685/2020 (as introduced by virtue of Article 41 of Law 5151/2024), marking a fundamental shift in investment priorities toward merchant BESS, i.e. standalone storage projects operating solely on market revenues.

The Merchant BESS Priority Regime is a key component of Greece’s broader strategy to accelerate energy storage deployment, alongside the conversion of conventional power plants into storage units and the integration of storage systems into existing RES projects. By offering to merchant BESS a fast-track priority regime in receiving Final Grid Connection Offers (FGCOs), the Decision outlines, inter alia, eligibility criteria, priority rules, capacity caps, ownership concentration limits and financial assurance requirements.

With 4.7 GW of merchant BESS capacity now eligible under this regime, Greece is making a decisive move toward a more flexible, resilient and efficient energy system, with a view to reducing curtailments, enhancing grid stability and creating new investment opportunities.

Over the past five years, Greece has been steadily refining its energy storage policies, recognising BESS as a critical solution to increasing grid imbalances between supply and demand. The rapid growth of renewable energy sources (RES) - particularly photovoltaic (PV) projects - has surpassed the grid's capacity to absorb excess green energy, leading to frequent curtailments to prevent congestion. This has underscored the urgent need for large-scale energy storage solutions.

Until recently, the regulatory framework (Article 225 of Law 4920/2022, which has introduced Article 143ΣΤ in Law 4001/2011) primarily supported subsidised BESS projects via CAPEX subsidies and operational aid, through competitive tenders. However, following enactment of Law 5151/2024, merchant BESS takes center stage, setting the foundation for a more dynamic, market-driven energy storage landscape.

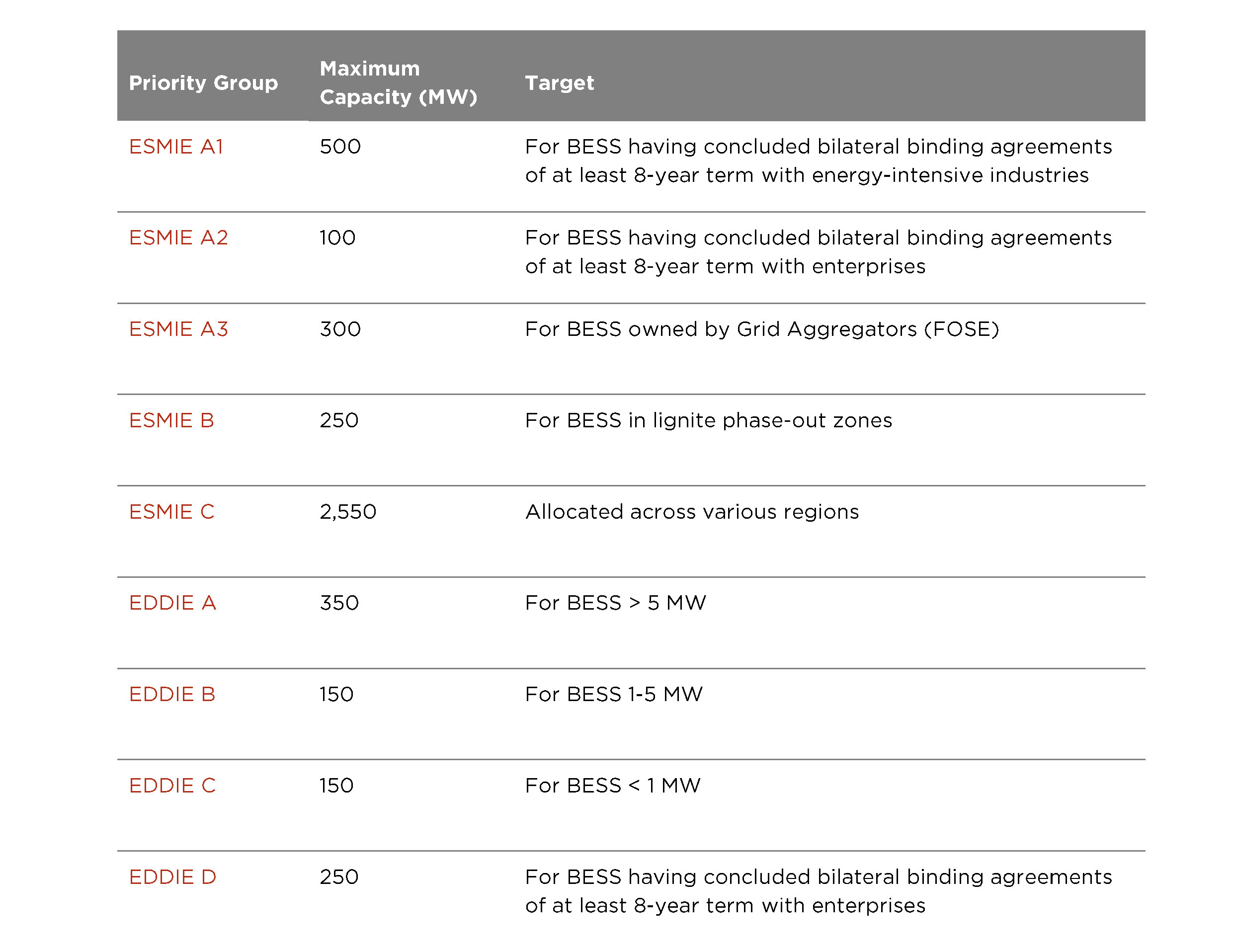

The Decision classifies eligible projects into priority groups, each subject to specific capacity caps based on factors such as:

the conclusion of bilateral binding agreements

geographical location, prioritising areas with excess RES production

eligibility for BESS projects owned by Grid Aggregators (FOSE)

A structured breakdown of priority categories and their respective capacity limits is outlined in the table below, depending on whether the BESS project is to be connected to the Transmission System (ESMIE) or the Distribution System (EDDIE):

To be eligible for this priority regime, investors must demonstrate financial robustness by submitting (a) a Priority Bond and (b) a bank pre-approval for project financing and/or proof of available own funds.

To prevent concentrations in the market, the Decision imposes cumulative ownership caps:

A maximum capacity of 250MW per investor and its related parties (with sub-caps per Priority Group) for standalone BESS under the Merchant BESS Priority Regime; and

A total maximum capacity of 500MW per investor and its related parties until 2029 for Standalone BESS or BESS combined with RES projects (but excluding self-generation storage units).

Beyond financing assurance and ownership concentration criteria, eligible BESS projects must also meet specific technical and licensing requirements. Among others, they must hold a valid storage permit, have submitted an FGCO application, have received environmental permitting approval, and have not participated, or intend to participate, in auctions for investment subsidy and operating aid.

BESS connected to the Transmission System (ESMIE Groups): 90 days from the publication date of the Decision (and 150 days for Crete, Ionian & Cyclades islands).

BESS connected to the Distribution Network (EDDIE Groups): 150 days from the publication date of the Decision.

BESS holders must submit a readiness declaration within 18 months of the FGCO acceptance. Failure to meet this deadline results in Priority Bond forfeiture.

Upon receiving an FGCO, the Priority Bond is replaced with a Performance & Operation Bond of a same amount (i.e. 200,000 Euro/MW for BESS connected to the Transmission System (ESMIE) and 50,000Euro/MW for BESS connected to the Distribution Network (EDDIE). The Performance & Operation Bond amount is reduced by 50% after three (3) years of BESS operation and fully returned after six (6) years of BESS operation.

The introduction of the Merchant BESS Priority Regime marks a significant milestone for the Greek energy sector, driving investment opportunities in the BESS market.

The BESS Priority Regime’s effectiveness will be mainly shaped by:

Financial institutions’ willingness to fund merchant BESS, not benefiting from investment subsidies or operational aid, requiring banks and investors to assess and manage market risks. Long-term tolling agreements with energy-intensive industries or enterprises could create a more secure path to project financing, as they can offer predictable revenue streams, reduce market exposure, and enhance overall bankability.

A clear and well-structured legal framework regulating the entire BESS lifecycle, including the participation of the BESS projects into energy markets.

Investors should thoroughly evaluate both the Merchant BESS priority regime and the alternative fast-track regime for BESS projects co-located with RES at a shared grid connection point to identify the most strategic approach.

As Greece accelerates its energy transition, the introduction of the Merchant BESS Priority Regime can pave the way for the large-scale integration of energy storage systems into the national grid.