Security Alert

The expected legislative amendment for the size criteria adjustment of Greek undertakings and groups, in line with the Commission Delegated Directive (EU) 2023/2775, was brought about by a new law published in December 2024. The revised regulations, affecting various reporting obligations of businesses, become effective for financial years starting from 1 January 2024.

Click here for the GR version – Πατήστε εδώ για το ελληνικό κείμενο

Law 5164/2024, published on 12 December 2024, transposes into Greek legislation the Commission Delegated Directive (EU) 2023/2775, amending Directive 2013/34/EU, on the adjustment of the size criteria for EU undertakings or groups.

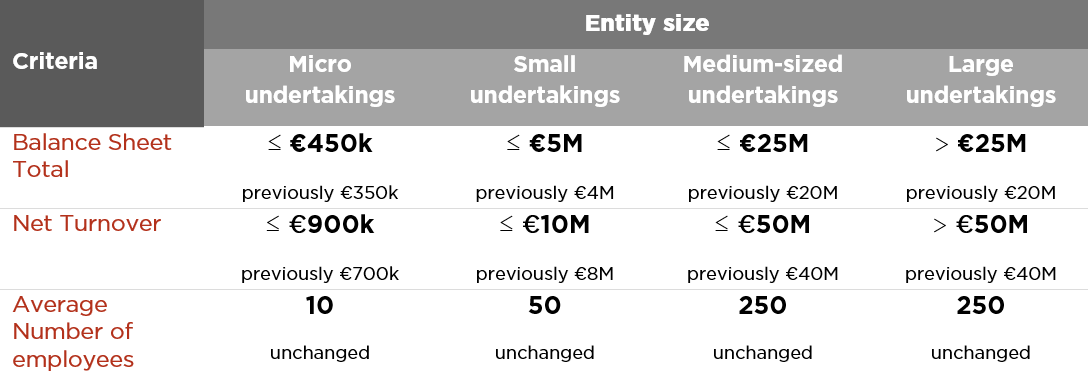

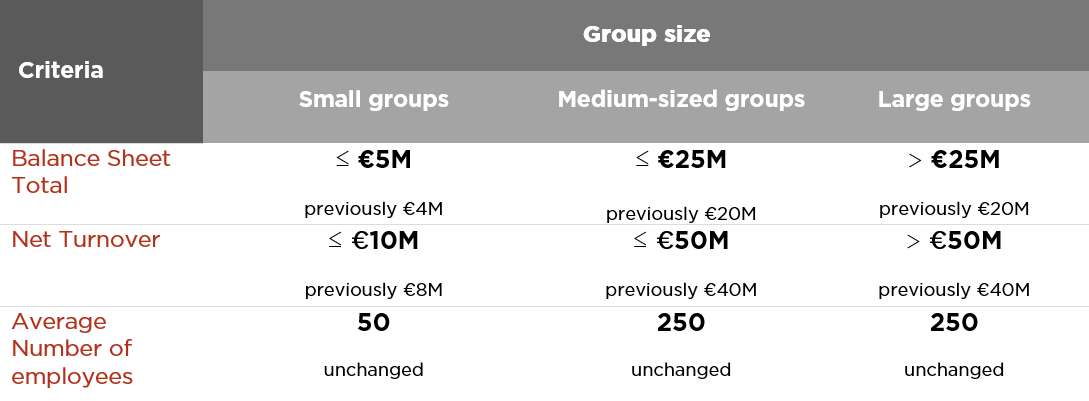

In effect, the new law establishes revised monetary size criteria under Greek GAAP in terms of balance sheet total and net turnover figures for micro, small, medium-sized and large undertakings while it also defines the adjusted quantitative criteria for the classification of groups’ size for consolidation purposes. The definition of “net turnover” is also revised by virtue of the new regulations aiming to provide a more simplified denotation in alignment with the applicable corporate law provisions.

Above changes, which apply in respect of financial years starting from 1 January 2024, affect various entity-size driven reporting obligations of Greek businesses and groups. Among others, the new increased size criteria thresholds will reduce the application scope of the presentation, audit and publication requirements for financial statements provided by the current Greek GAAP framework but also determine the reporting obligations arising from other regulations, such as the CSRD.

The revised size criteria for the classification of Greek undertakings are presented in the below indicative table.

The revised size criteria for the classification of groups are presented in the below indicative table.

For size classification purposes, an undertaking or a group must meet at least two of the above three quantitative thresholds in the financial year of reference.

Change in the size classification takes place if the undertaking or the group exceeds or ceases to exceed the above criteria for two consecutive periods; in such case, the change is effective as from the period following the aforesaid two consecutive periods.

Undertakings in the form of limited partnerships, general partnerships, sole proprietorships or other entities implementing Greek GAAP based on tax or other law provisions are classified as micro-undertakings on the sole condition that their turnover does not exceed €1.5M.

For the classification of groups, the applicable balance sheet total and net turnover thresholds are considered following set offs and eliminations provided by relevant consolidation rules. If these are disregarded, the above thresholds are increased by 20%.

The definition of “net turnover” is revised making also special reference to insurance undertakings and credit institutions in view of further simplification and its alignment with corporate law provisions.

In particular, the net turnover represents the amounts derived from the sale of goods and the provision of services following deduction of sales discounts, VAT and other taxes directly related to the turnover. For insurance undertakings, the net turnover is defined in accordance with specified articles of Council Directive 91/674; for credit institutions the net turnover is defined in accordance with the regulations of Council Directive 86/635, while for specific undertakings falling within the scope of sustainability reporting requirements of Greek corporate law, it represents revenue in accordance with the applicable financial statements reporting framework.