Security Alert

Following the OECD’s updated guidance on tax treaties and the impact of the COVID-19 crisis, which was issued on 21 January 2021, the Greek tax administration provided additional guidelines with respect to the application of Greek tax residence and permanent establishment rules in the context of the pandemic.

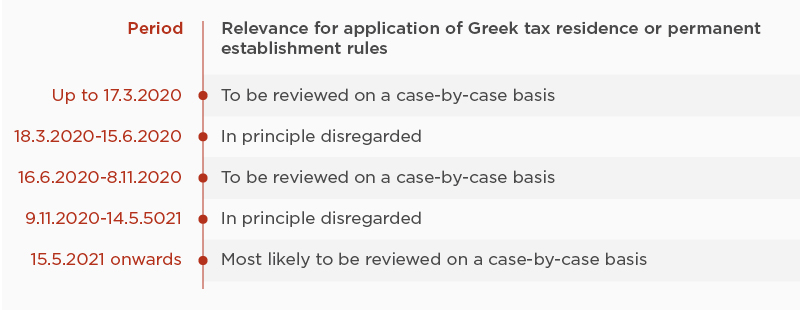

In particular, with Decision E.2130/2021, the Independent Authority for Public Revenue clarified that the period spanning from 9 November 2020 to 14 May 2021 will, in principle, be disregarded for purposes of assessing:

As per the earlier guidance, the period from 18 March 2020 to 15 June 2020 should also not be taken into account for purposes of applying the domestic rules on tax residence and the existence of a permanent establishment of the employer in Greece.

Finally, it is clarified that the impact of physical presence in Greece from 15 June 2020 to 9 November 2020 should be examined on a case-by-case basis and in light of the applicable travel restrictions.