On 17 October 2015, the Greek Parliament ratified Law 4337/2015 , in implementation of some of the terms agreed between Greece and its debtors in the context of the third bail-out program. The present tax newsletter summarises key changes introduced in the field of taxation.

Revised penalties for failure to file tax Returns or filing of inaccurate tax returns assessed upon completion of a tax audit

Among others, Law 4337/2015 amended part of the provisions of the Greek Code of Tax Procedures (Law 4174/2013), in relation to the penalties that apply for a number of violations of Greek tax legislation.

The purpose of the new rules is (a) to reduce the amounts of generally applicable penalties for failure to file or for filing inaccurate tax returns, including withholding tax returns, in order to increase actual collection and (b) to segregate the treatment of violations impacting the collection of VAT, given the significance of the specific tax. Furthermore, the issuance of inaccurate fiscal documents or non-issuance thereof, which used to be an infringement subject to a fixed penalty of Euro 500 per fiscal document, capped at the amount of Euro 30,000, has now become subject to a fixed penalty of Euro 2,500.

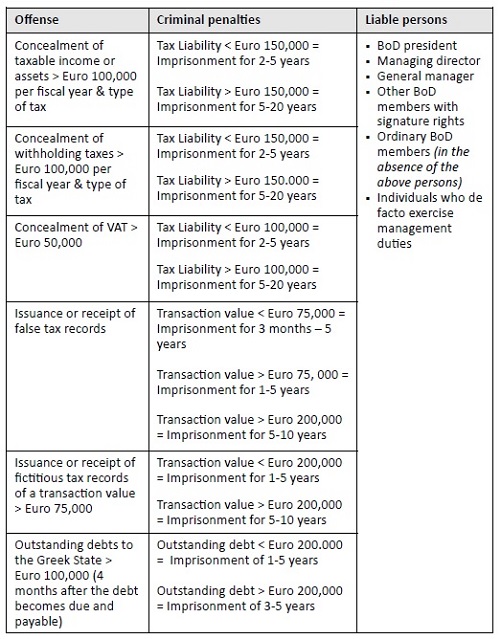

According to the new rules the following penalties apply:

The revised penalties apply for tax assessments that will take place following submission of the new law, and for violations that occurred in fiscal years that started after 31 December 2013.

Furthermore, taxpayers may opt to benefit from the revised penalties in relation to tax disputes that are currently pending before the Greek administrative courts or the Tax Dispute Resolution Directorate. However, the option is subject to the condition that the relevant taxpayer will withdraw from the pending tax dispute by accepting the findings of the tax audit.

The option may be exercised within 90 days from publication of the new Law in the Government Gazette (i.e. until 16 January 2016) or the official notification of the relevant assessment to the taxpayer.

Relaxed penalties for violation of TP compliance obligations

Transfer pricing legislation imposes certain compliance obligations to Greek enterprises, namely the obligation to report annually intra-group transactions performed during the previous year and the obligation to document such transactions in the context of local transfer pricing files.

Law 4337/2015 has relaxed the penalties that apply for the violation of such obligations as follows:

The revised penalties apply for any assessment that will take place from the date of publication of the new law in the Government Gazette and that concerns violations committed after 1 January 2014.

Fictitious/forged fiscal documents; abolition of penalties for future violations and transitory provisions

Until now, the issuance or receipt of forged/fictitious invoices was sanctioned by self-standing penalties, proportional to the value of the relevant invoice, in addition to any income tax or VAT implications triggered from the issuance/receipt of such invoices.

Law 4337/2015 repealed these penalties for future violations. Furthermore, the new law has introduced transitory provisions for infringements that took place until the publication of the law and in relation to which no final assessments have been issued yet. These transitory provisions set lower penalties for the infringements in question compared to the previously applicable regime, which range in principle between 10% - 50% of the value of the respective invoices.

The reduced penalties also apply to cases for which final assessments have already been issued but have not been challenged, as well as for cases which are pending before the Dispute Resolution Directorate of the Ministry of Finance or the Administrative Courts. In order however for the reduced penalties to apply, the interested parties need to irrevocably accept that they have committed the relevant infringements.

Criminal tax evasion: changes in scope and applicable penalties

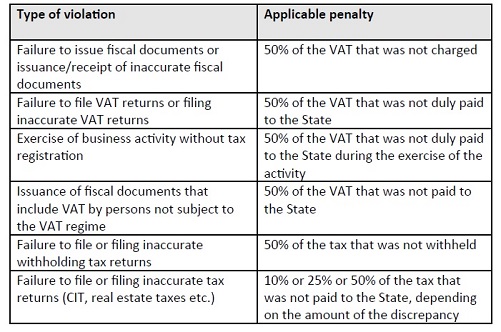

Legal provisions governing criminal tax evasion have been incorporated in the Greek Code of Tax Procedures (Law 4174/2013). Highlights of changes in the scope of criminal tax evasion have as follows:

- The scope of criminal tax evasion becomes broader and includes the concealment of taxable assets. In this respect, the non-disclosure of Greek taxable real estate property constitutes criminal tax evasion in the event that it results to non-payment of the Uniform Real Estate Tax or of the 15% Special Real Estate Tax.

- Under the new law, any person who de facto exercises management duties in the company may be held liable for criminal tax evasion, in addition to individuals holding specific executive positions (e.g. Managing Director).

- The new law introduces criminal liability of proxies of the taxpayer who sign inaccurate tax returns and of individuals who serve as legal representatives of any type of legal entity in Greece. On the other hand, the criminal liability of the head of the accounting department of a company is abolished.

- The criminal courts are no longer required, but have the option to postpone the hearing of the case until the administrative courts issue an irrevocable decision on the tax dispute.

- Tax evasion is no longer considered a flagrant (“caught in the act”) crime.