Reduction of the rate of listed shares sales tax, VAT on short-term rentals and other recent tax changes relevant to corporate taxpayers in Greece.

Reduction of the rate of sales tax applicable on trades of listed shares

The rate of tax which applies under Greek law on sales of shares listed on a regulated market or multilateral trading mechanism (regardless of whether the relevant transactions are carried out inside or outside those trading venues) is reduced from 2‰, to 1‰. The reduction is applicable in respect of transactions with a settlement date which falls on or after 2 January 2024. The relevant amendment was introduced by virtue of article 50 of Law 5073/2023.

VAT on short-term rentals

Under the guidelines in force until now, short-term rentals by legal persons were exempt from VAT provided that, apart from accommodation and bed linen, no further services (such as cleaning) were provided. According to the newly voted Law 5073/2023 however, as of 1 January 2024, short-term rentals by legal persons will be subject to 13% VAT in all cases, namely irrespective of whether additional services are provided or not.

VAT rates

The application of reduced VAT rates (13% and 6% as the case may be) that had been introduced for a limited period of time on certain goods and services becomes now permanent. This includes, among others, goods for personal hygiene (6%), works of art (13%), cinema tickets (6%), gym subscriptions and dance schools (13%), transport of persons (13%), except taxis where the reduced rate will be applied until 30.06.24. Coffee will remain at the reduced rate of 13% until 30.06.2024.

Reduction of the rate of capital accumulation tax

The rate of capital accumulation, which is applicable among others on share capital increases by companies, is reduced to 0.2% from the previously applicable 0.5%. The reduction shall be effective in respect of taxable transactions occurring after 11 December 2023, i.e. the date of publication of Law 5073/2023.

Taxation of collective retirement saving schemes

Law 5078/2023 aiming at strengthening the optional collective retirement saving plans, introduces amendments as regards the tax treatment of contributions and benefits. The most important changes can be summarised as follows:

Tax exempt employment income

Contributions to institutions for occupational retirement provision (abbreviated in Greek as TEA) paid for retirement benefits, as well as premiums paid in the context of collective pension schemes that do not exceed 20% of the employees’ gross income, shall be tax exempt. Already existing defined benefit plans have been excluded from the relevant threshold rule.

The new rules shall apply for contributions paid and for income acquired as of 01.01.2024.

Taxation of benefits

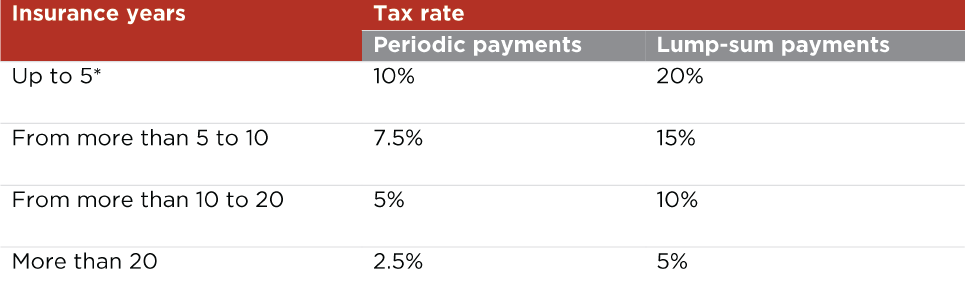

Pension benefits paid by TEAs as well as benefits paid in the context of collective pension schemes shall be taxed as per the rates shown below on the basis of the years of insurance they correspond to, such rates to be increased by 50% in case of early redemption by the beneficiary:

* For persons insured after the age of 55 these rates should be increased by 5% for each year that is below 5 years of insurance.

Amounts accumulated by the beneficiary up until 31.12.2023 should be taxed under the previously applicable provisions. While for the calculation of tax due on amounts accumulated after 01.01.2024, the total insurance years should be taken into consideration to determine the applicable tax rate.